omaha ne sales tax rate 2019

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The Gretna Sales Tax is collected by the merchant on all qualifying sales made within Gretna.

Property Taxes Explained Omaha Relocation

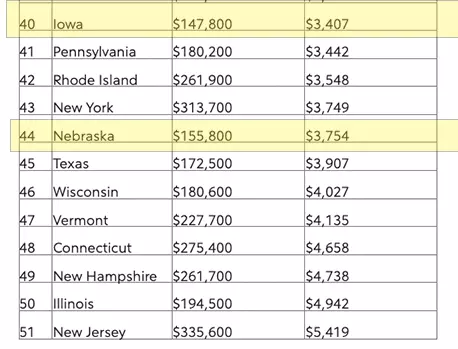

At the low end only 69 of general tax revenue collected in Alabama comes from property tax while at the high end property tax is 365 of general tax revenue in.

. Also effective October 1 2022 the following cities. The Omaha sales tax rate is. For those interested in architecture the building on the property was built in a ranchrambler style.

Orchard NE Sales Tax Rate. Still Nebraska collected 123 million. Statewide sales tax rate 55 Economic Sales Threshold 100000 Transactions Threshold 200 Website Department of Revenue Tax Line 4024715729 Nebraska Sales Tax Calculator Calculate Rates are for reference only.

Ord NE Sales Tax Rate. Wayfair Inc affect Nebraska. The Department of Revenue announces that effective October 1 2019 the Sales Tax Rate Finder will be provided through a partnership with the Nebraska Geographic Information Office GIO.

Sales Tax Rate s c l sr. Did South Dakota v. The monthly payment on this vehicle is an estimate based on the sales price of 28995 calculated on a 899 APR for 48 months with a down-payment of 15.

This has been categorized as a residential property type. Orleans NE Sales Tax Rate. Despite increases to the state sales tax rate and the approval of more tax exemptions the sales tax has not become a more effective revenue source for the state.

4629 South 108th Street Omaha NE 68137 CALL OR TEXT. A county sales and use tax is only imposed on taxable sales within the. The 775 sales tax rate in Omaha consists of 65 Arkansas state sales tax and 125 Boone County sales tax.

The Omaha sales tax rate is. Groceries are exempt from the Nebraska sales tax. The Gretna Nebraska sales tax is 550 the same as the Nebraska state sales tax.

S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate. Ohiowa NE Sales Tax Rate. There is no applicable city tax or special tax.

Alice Homan 8 of Omaha pretends to use a telephone alongside her mother Sen. The County sales tax rate is. L Local Sales Tax Rate.

Registration Year Base Tax Amount 1 2 3 4 5 6 7 8 9 10 11 12 13 14 95 year 1 see below. For tax rates in other cities see Nebraska sales taxes by city and county. Net sales taxes for the year were 21 below that forecast while net individual income taxes were 201 higher and net corporate income taxes were up 182.

The new Sales Tax Rate Finder will be based on GIS mapping and will provide the correct state sales tax rate along with any applicable local tax rate and the. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Osmond NE Sales Tax Rate.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. You can print a 7 sales tax table here. According to the Nebraska Department of Revenue the Dakota County sales and use tax rate will no longer be effective for taxable deliveries made within the Dakota City boundaries as of January 1 2019.

May not include all information needed for filing. It is a single story home. House located at 2310 N 67th Ave Omaha NE 68104 sold for 80000 on Aug 27 2019.

That statistic is worrisome since those counties usually bring in a sizable portion of the taxable sales. Sr Special Sales Tax Rate. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

2 beds 1 bath 1112 sq. The sales tax has been at a relatively consistent average of 37 percent of total state tax collections. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75.

The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax. The Nebraska sales tax rate is currently. VISIT US.

Osceola NE Sales Tax Rate. Oshkosh NE Sales Tax Rate. Ong NE Sales Tax Rate.

Otoe NE Sales Tax Rate. Lancaster County had a similar situation where they saw a drop of 19 in 2019 and a drop of 75 in 2020. Welcome to 17025 Aurora Street located in Sarpy.

A new 05 local sales and use tax takes effect bringing the combined rate to 6. Omaha NE Sales Tax Rate. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15.

This is the total of state county and city sales tax rates. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality. What is the sales tax rate in Omaha Nebraska.

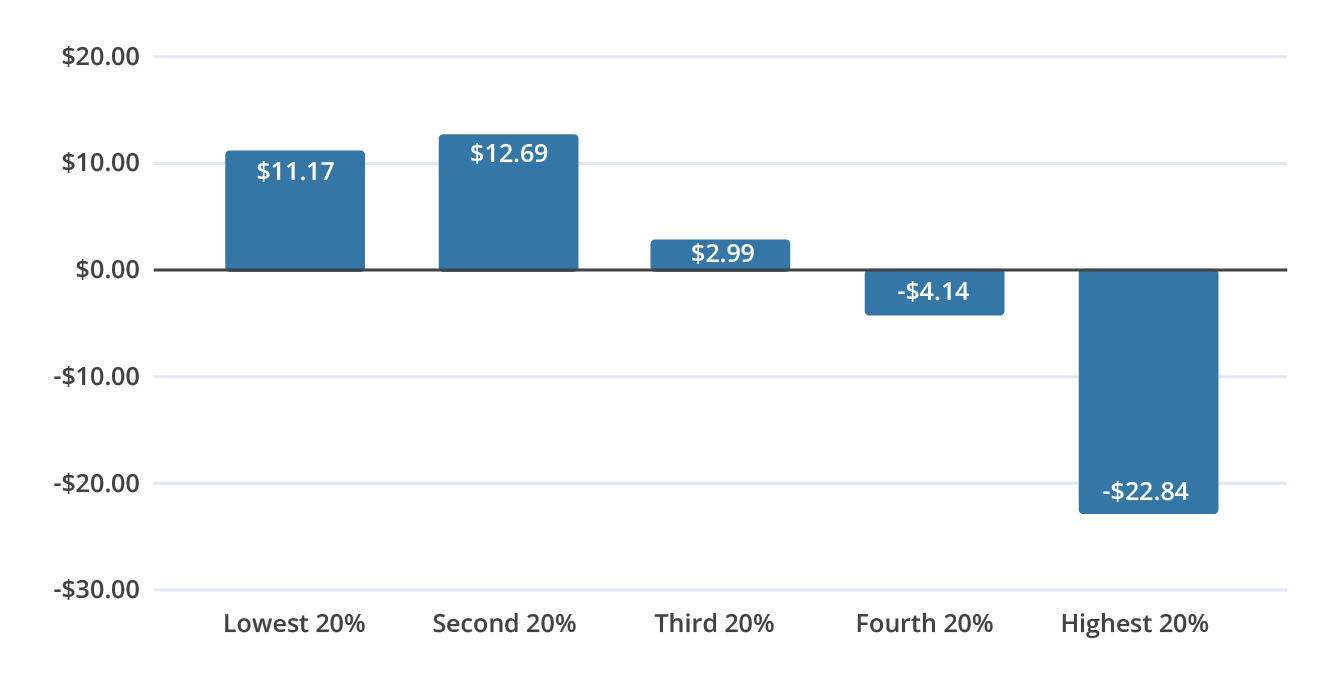

There are a total of 0 rooms in the home of which 3 are bedrooms. As we can see from Figure 4 the state is relying more heavily on the income tax than the sales tax. According to the Nebraska Department of Revenue the Dakota County sales and use tax rate will no longer be effective for taxable deliveries made within the Dakota City boundaries as of January 1 2019.

You can print a 775 sales tax table here. View sales history tax history home value estimates and overhead views. 05 lower than the maximum sales tax in NE.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The top five most populous counties in Nebraska saw an average drop in taxable sales revenue of 636 compared to the previous year. There is no applicable county tax or special tax.

Try the API demo or contact Sales for filing-ready details. For tax rates in other cities see Arkansas sales taxes by city and county. The Nebraska state sales and use tax rate is 55 055.

17025 Aurora Street in Omaha NE was first built in 2018 and is 3 years old. The Nebraska state sales and use tax rate is 55 055.

Sales Taxes In The United States Wikiwand

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Nebraska Income Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Tax News Views Minimum And Bachelor Tax Roundup

Sales Tax On Cars And Vehicles In Nebraska

Follow Webster Groves School District S Webstergrovessd Latest Tweets Twitter

Sales Taxes In The United States Wikiwand

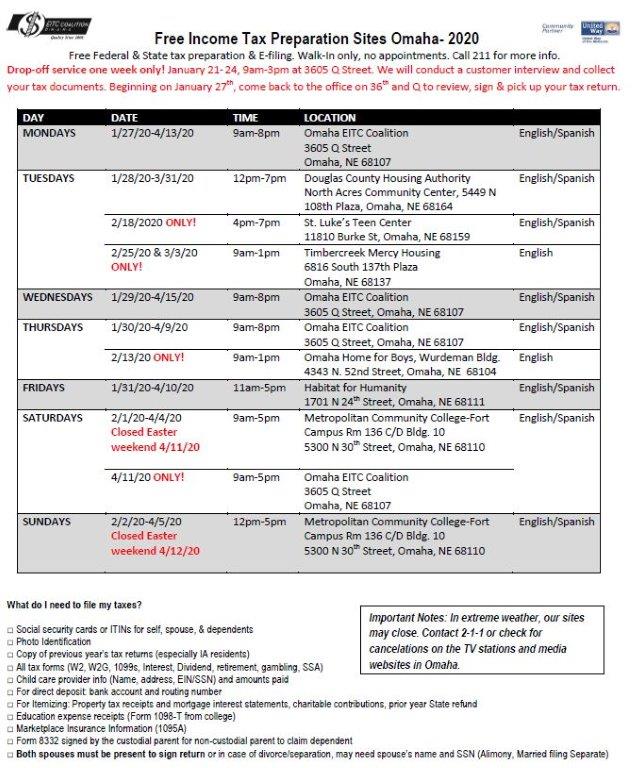

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

Carbon Taxes Without Tears The Cgo

Nebraska Sales Use Tax Guide Avalara