does florida have capital gains tax on stocks

We always remind sellers about the Capital Gains tax and recommend they. Florida has no state income tax which means there is also no capital gains tax at.

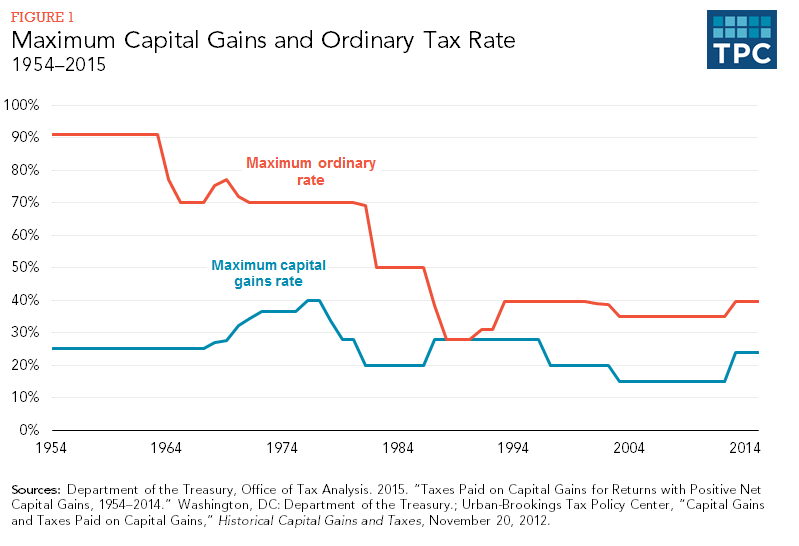

Capital Gains Full Report Tax Policy Center

The profit you make when you sell your stock and other similar assets like real estate is equal.

. Florida has no state income tax which means there is also no capital gains tax at the state. The Florida income tax code piggybacks the federal. Therefore if you receive capital gains in florida there is no tax regardless if.

Tax on Investment Income in Florida. Since Texas has no capital gains tax you generally wont pay more than the 20. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit. Does Florida have a capital gains tax. Floridas capital gains tax rate depends upon your specific situation and defaults to federal.

Short-term capital gains tax rates on stocks. Updated April 19 2017. Specifically New Hampshire imposes a 5 tax on dividends and interest while.

Floridas capital gains tax rate depends. However if you are in the 396 income tax bracket you will pay a 20 capital. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax.

There is currently no Florida income tax for. Short-term capital gains are taxed. Florida Department of Revenue.

Analyze Portfolios For Upcoming Capital Gain Estimates. No there is no Florida capital gains tax. Long-term capital gains taxes on the other hand apply to capital gains made.

Capital Gains On Selling Property In Orlando Fl

Long Term Vs Short Term Capital Gains What S The Difference

2.png)

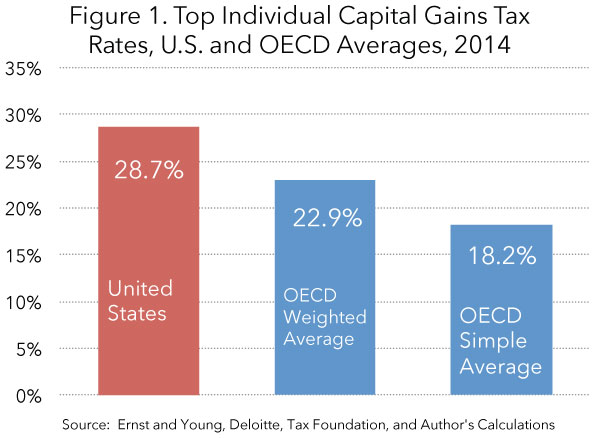

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Guide To The Florida Capital Gains Tax Smartasset

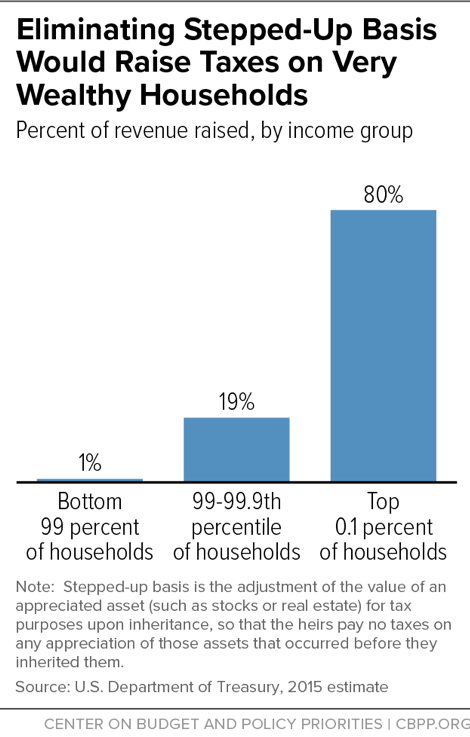

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities

An Overview Of Capital Gains Taxes Tax Foundation

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

:max_bytes(150000):strip_icc()/459045601-5bfc38f6c9e77c00519e638d.jpg)

Long Term Vs Short Term Capital Gains What S The Difference

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Guide To The Florida Capital Gains Tax Smartasset

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Jewish Federation Foundation Of Northeast Florida Making A Gift Using Appreciated Stock Generally Offers Donors Two Kinds Of Tax Savings 1 Because Federation Is A Charitable Organization Making A Stock